Modelling natural catastrophe risk for offshore wind farms

Future-proof offshore wind farms with Renew Risk’s natural catastrophe risk modelling insights

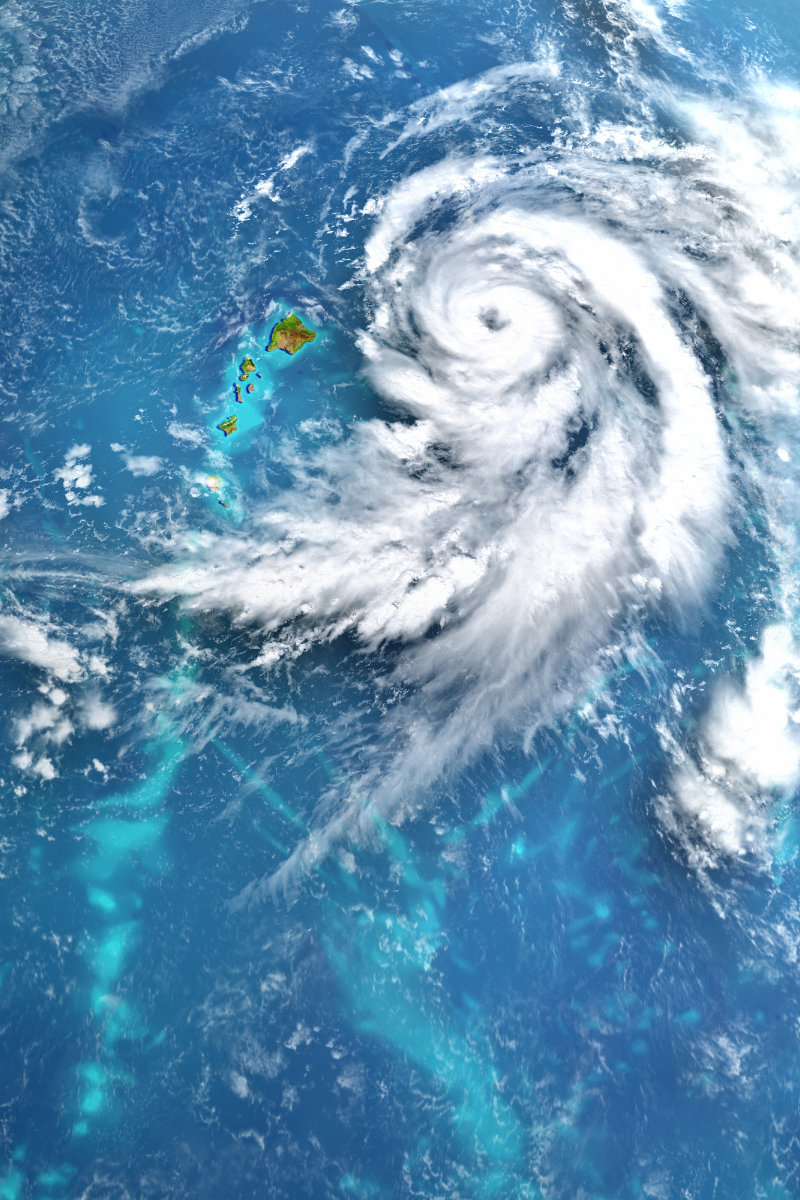

The energy market is in full transition, with an ever-growing inventory of renewable energy infrastructure. However, these large-scale projects are increasingly being built in natural catastrophe zones - and the natural disasters are expected to become more intense and more frequent in the future.

Catastrophe modelling plays a crucial role in assessing and managing risk to offshore wind farms. Renew Risk is the only organisation providing risk modelling specifically tailored to renewable energy assets.

Our advanced risk modelling enables organisations to:

Increase pricing accuracy

Reduce uncertainty

Improve financial planning.

Typical natural catastrophe risk models were designed for onshore property and traditional insurance exposures, and fall short when applied to offshore wind farms.

Introducing Renew Risk - the renewables risk management specialists

Providing enhanced risk models built from the ground up specifically for offshore wind farms. Strengthen resilience and decision-making for offshore wind farms around the globe with Renew Risk’s catastrophe models.

-

UK Windstorm Model

A comprehensive view of windstorm risk to offshore wind farms around the UK.

-

Europe Windstorm Model

Build resilience into your risk management for offshore wind farms along the European coastline.

-

Japan Earthquake Model

Access specialist risk intelligence for offshore wind farms located around earthquake-prone Japan.

-

Japan Typhoon Model

Understand your exposure to typhoons in Japan.

-

Taiwan Earthquake Model

Manage your offshore wind farms in Taiwan with an extensive view of earthquake risk for the region.

-

Taiwan Typhoon Model

Estimate typhoon losses to support risk management for offshore wind farms in Taiwan

-

US Hurricane Model

Quantify hurricane risk for assets located on the East Coast of the US.

A framework for Renew Risk’s offshore wind catastrophe models

-

A mix of historic and stochastic events representing 10,000 years of activity. The spatial extent of events, characterised by size, location and return period, per grid cell.

-

Explicitly capturing the wind and wave intensity for the areas of exposure.

-

Asset value distributions. Renew Risk’s exposure data includes extra expenses – a per-asset cost of repair / reinstatement above the per-asset cost of initial installation. This includes vessel-costs and a loss of economies of scale, and each is defined by event and wind farm.

-

In some parts of the world, offshore wind farms are a new addition to the energy mix. In other regions, wind farms are undergoing repair and replacement activities to expand their generating capacity and lifespan. In both scenarios, this results in limited claims data. Renew Risk specialist approach to vulnerability comprises:

Reviewing existing damage and claims data

Laboratory testing at the University of Surrey by Renew Risk Co-Founder Professor Suby Bhattacharya

Expert elicitation from cross-industry consultants.

-

Calculating various loss metrics for different financial perspectives.

Key features of Renew Risk’s natural catastrophe models for offshore wind farms

In-depth risk insights

Our models offer an unparalleled level of detail, capturing asset-specific features such as substations, cables and foundations, with modifiers including soil type and asset age.

Regionally calibrated

Traditional risk models use wind only landfall-calibrated measurements. Renew Risk’s models are built using at-site calibrations for wind speed and explicitly capture wave height.

Industry validated

We believe the best models are built together. We partner with leading experts across insurance, data science and engineering to create models that are asset-focused and enable risk professionals to navigate the complexities of offshore wind farm exposure with confidence.

Science driven

Underpinned by calculations by world-leading experts and enhanced by real-world experiments conducted in university labs.

Location specific

Capturing unique features for offshore wind farms, such as vessel mobilisation / demobilisation costs and supplier surcharges.

Interested in risk insights beyond natural catastrophes? Learn more about the risks across the entire offshore wind farm lifecycle

Download our overview PDF.

Testimonials

Quantify and manage the risk of catastrophic events with Renew Risk’s offshore wind models

Get in touch to learn more.

Frequently asked questions

-

Renew Risk provides enhanced risk intelligence and modelling for renewable energy infrastructure around the globe. These risk analytics help insurers, developers and financiers to understand, manage and quantify the risks to their renewable assets - whether that’s financial risk, engineering failures and faults or natural catastrophes.

-

Renew Risk’s product portfolio is specifically tailored to renewable energy infrastructure. These in-depth risk insights are key for risk professionals to effectively quantify and price risk.

Prior to Renew Risk’s formation, no commercially available risk models on the market were specifically tailored to the renewable energy asset class.

-

In addition to renewable sites growing in size and frequency, they are increasingly being constructed in regions prone to extreme weather events. Improved risk modelling for renewable assets supports better planning, pricing and resilience strategies.